Does it take 3 weeks to close your books?

I create the specialized accounting processes online marketplaces need to succeed.

-

✓ Decrease time to close

-

✓ Eliminate data entry errors

-

✓ Automate tedious KPI reporting

Are you a CFO or Ops Lead who’s struggling to get the financial information you need, month after month?

Accounting Managers

"The data’s just not there."

Dev Teams

"We don't have the resources."

Does it seem like every internal solution you propose is met with some version of "no"?

Are you tired of only hearing why things won’t work or simply can’t be fixed?

IT Departments

“It’s impossible!”

I can help you start closing your books in days instead of weeks.

Ask yourself:

Are you drowning in transactions?

Is your inbox overflowing with payment requests?

Is it hard to know who you've paid and who you haven’t?

Are you worried you’re dropping the ball with AR and AP?

Does it take too long to close the books every month?

Does it seem like investors are always asking “Are last month’s financials ready yet?”

Does the CEO want to step on the gas while the wheels are falling off as it is?

Are you actually scared about what would happen if the sales team landed a big new contract?

Guess what?

The problem’s not with you.

The problem is that managing financial transactions from a online marketplace or platform is incredibly complex. Processing payments while ensuring accuracy and authenticity across all parties involved requires a high level of expertise that few companies have access to.

Yes, it might seem like at the end of the day your platform is just another online marketplace that only needs some e-commerce funcionality and an integration with Stripe Connect. And once those are set up, at least for awhile, it may even seem like it's working. But as you're now realizing, standard e-commerce solutions fall short and don’t meet the needs of even the most basic online marketplaces. As your platform takes off and transaction volume grows, so do the cracks in your payments system...only those cracks tend to grow exponentially, outpacing platform growth.

Your online marketplace probably started with questions like “The person who sells something on my platform...what do I call these people?” but those eventually gave way to more difficult questions like “How am I supposed to pay them, anyway? How do I account for the fee that gets taken off every sale? Those fees supposedly end up in my bank account…but do they actually? And how could I prove it if I had to?”

If questions like these or an onslaught of transactions and angry emails are holding you back and making each day feel like a fight to keep your head above water, unwind it and get answers by booking a call with me.

Things I can help you with on our call:

Which of your potential problems is the most important to focus on first (and why!)

How to track purchases, payments, fees, and prove they're 100% accurate to anyone who asks

How to manage payment terms for purchases made on your online marketplace

How to generate complex, platform-specific reports (e.g. list of buyers with unpaid purchases, organized by seller)

What to automate first, and how to start

How to develop a solid accounting process foundation to build on, where the annoying, dishwater-boring tasks are processed while you’re at lunch, and you can get back to doing what you signed on to do in the first place (which, I assume, was not the boring stuff)

You didn't make it this far to get overwhelmed by accounting problems.

Scale fast, and get back to doing what you do best — book your free consultation call today!

Ways we can work together

Sometimes it seems like problems are cropping up so fast, and in so many different areas, it’s hard to know where to start. The FastClose℠ Strategy Consult is a 60 minute call to identify the operational bottleneck issues keeping you from closing your books in days instead of weeks.

A monthly advisory retainer to design and oversee the implementation of a new strategic process for managing your company’s financials.

Raising a round? Selling your company? If you’ve been been doing what you needed to keep your business growing while your financial processes and reporting took a back seat, no one would blame you. Just remember: investors or buyers will eventually ask to see your books. When that happens, do you want to feel terrified or feel like a rockstar?

Let me streamline your financial operations and when that day comes, you’ll show them numbers so airtight, the only thing they’ll want to know is where to sign.

The FastClose℠ Implementation project is a 1 - 6 month engagement where I design and build systems to get your books closed in days instead of weeks. The foundation of this project is a rigorous search for —and resolution of— any material operational or historical problems.

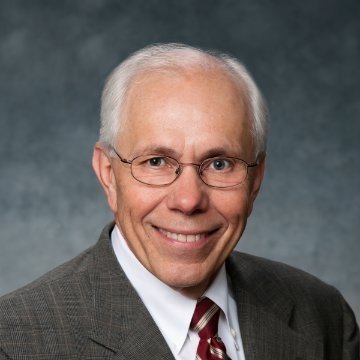

What CFOs are saying…

Jonah drove significant improvements across our credit card billing reconciliations process. Using both internal and external tools, Jonah simplified these critical reconciliation processes, matching receivables and payables representing over 2 million ticketing purchases through the Vendini software. The changes shortened our process by several days and allowed the Accounting Team to close earlier in the month.

Jonah worked with me to overhaul the enterprise systems and accounting environment at Zume. The "go to" person for understanding how old data needed to be cleaned before it would be useful in the new environment, Jonah’s data prowess and interest in going beyond, to understand the impact of data on business results, is something that is rare, and far exceeds that of most accountants.

Jonah thrives on helping businesses grow through technology. Owners and managers have enough on their plate, so as work load / deliverables / production continue to increase, adopting some level of accounting automation is the only way to meet demand. Human touch is critical, but automation simply produces better results, faster. From a business owner perspective this can mean more money, or simply being able to compete.

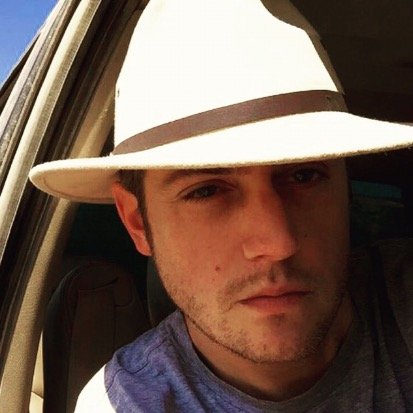

Who is this guy, anyway?

I’m Jonah Purinton. As an accountant and software developer, I’ve spent the last decade helping some of Silicon Valley’s top CFOs and operations leads scale their accounting environments so they could stop fighting fires and focus on higher-level work instead. Since starting Reflex Accounting in 2016, I’ve helped many marketplaces, including hospitality-focused Urbandoor (acquired by Airbnb, August 2019) and esports disrupter Streamlabs (acquired by Logitech, September 2019) manage financial aspects of their product and internal back-office operations.

I noticed CFOs were so busy negotiating leases and raising capital that few had time to implement or oversee (often slow, arduous) fundamental accounting processes. Even fewer had found time to consider how to adapt those processes to overcome the platform economy's frustratingly complex challenges. The catastrophic consequences of transactional backlogs and oversights, two of the most significant threats to peer-to-peer marketplaces, were going unnoticed until it was too late. The needless damage these were doing to businesses kept me up at night. Now I’m on a mission to elevate the humanity of the accounting profession, helping finance professionals make a difference by replacing busywork with real work. ✅